Prepared for the SPEER Commission on Energy Efficiency Policy

SPEER Staff

December 2014

For the PDF version of our whitepaper, click here.

Introduction

Energy efficiency provides significant public benefits, and historically utilities have been seen as valuable and appropriate partners to the states in administering energy efficiency programs. Utilities understand energy and how homes and businesses use it, and they are already subject to extensive regulatory oversight by a state commission.

A drawback to having utilities conduct energy efficiency programs, however, is that, under a traditional regulatory approach, it was not always in their economic interest to do so. An energy efficiency program would tend to reduce consumption by a utility’s customers from what might otherwise be expected, and thus potentially reduce the utility’s revenues from the level needed to cover costs already incurred; it is, under the current system, an expensive, risky, and lengthy regulatory process to seek higher rates from the State to make up the difference. In short, utilities have a disincentive to conduct energy efficiency programs.

How utilities earn their revenues, however, affects a broader range of considerations than just the impact of energy efficiency programs on sales. The existing revenue recovery model for utilities may provide disincentives for utilities to seek out efficiencies in other respects as well. The adoption of advanced meter data networks is stimulating innovation in information-driven third-party customer services, like demand response and energy management applications. Utilities themselves are also using the new digital data networks, for example, to reduce operating costs or improve services. They may also be able to leverage the network to reduce the need for capital investment in distribution infrastructure.

Some observers argue that utilities have an incentive to invest in capital projects, since capital investments are the key source of utility profits. In these circumstances, utilities would be expected to prefer to address problems through capital investment rather than through expenses, even if the expense-based solution is the lower cost solution for all customers. To the extent the rate-making process is effective, regulators would be able to determine whether utilities are adopting least-cost solutions, and utilities face regulatory disallowances of capital investments or expenses that are not prudent and reasonable. However, regulators may not have the resources to effectively review utilities’ transmission and distribution investment.

This discussion is not a condemnation of utilities, but is simply a description of the incentives that are inherent in traditional rate regulation, and part of the environment that affects utility decision-making. Regulatory mechanisms have been developed over the last 35 years, and are now used in a majority of the states to change the incentive structure, or attempt to internalize a drive for greater efficiency by a state’s utilities. Some mechanisms have worked better than others, and none may be ready-made to apply to the uniquely competitive Texas market. Still, there are a number of alternative mechanisms that bear consideration. First, however, this paper provides some background.

Description of Current Ratemaking

Traditional ratemaking for a regulated utility involves setting rates to recover the utility’s costs and provide it a return of its capital investment through depreciation, and a reasonable return on that investment through an authorized rate of return. Rate cases typically involve examining a utility’s expenses and capital investment at a moment in time and setting rates that the utility may charge from that time forward until the regulator revises allowed revenues and the rates again.

The rates are set with the expectation that the utility will have a reasonable opportunity to recover its costs and a reasonable return, but there is no guarantee that it will do so. Actual costs may change over time, either increasing or decreasing, so that the costs that were thought to be representative of the utility’s costs may no longer be an accurate reflection of what it must pay to provide the service. The level of customer consumption can also increase or decrease, and may be different from the level of consumption that was presumed when setting the rates. These cost and revenue changes may be either detrimental or beneficial to the utility. If the changes reduce the utility’s revenue, it may decide to initiate another rate case to raise rates. If revenues significantly exceed the level set by the regulatory commission, the regulator can initiate a proceeding to reduce rates.

As is noted above, success with energy efficiency programs can result in a net reduction of future revenue for the utility. Introducing a new energy efficiency program or increasing the magnitude of a program can have both a cost and a revenue impact. If a new initiative is adopted outside of the context of a rate case, normally the costs of the program would not be reflected in the utility’s rates. An new or expanded efficiency initiative would both reduce revenues and increase costs at the same time.

The rate-setting approach used in Texas is generally consistent with traditional rate setting, although there are some differences with respect to recovery of energy efficiency costs, that is, the cost of meeting the utilities’ goals for energy efficiency. The legislature has directed the Public Utility Commission to adopt rules to ensure timely and reasonable cost recovery for utility expenditures for energy efficiency and to reward utilities that exceed legislatively established energy efficiency goals. The Commission has implemented this legislation by adopting a separate rate-setting process to annually recover energy efficiency program costs and by awarding bonuses for utilities that exceed their annual program goals. These rules address the concerns a utility might have about recovering the costs of an energy efficiency program and provide an explicit incentive for a successful energy efficiency program.

However, these rules do not directly address the disincentive related to reduced consumption and the reduced revenue that results from the energy efficiency program. Utilities in Texas have testified that significantly increasing utility spending on efficiency above current levels is likely to have a negative impact on their profitability, all else being equal.

Other Trends

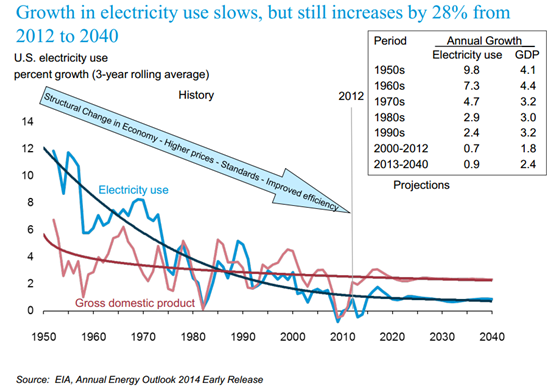

Part of the context for discussing the regulatory regime surrounding utility revenues is that there are significant changes beyond utility energy efficiency programs affecting the amount of electricity that customers buy from the grid. Over the last 50 years, more stringent energy efficiency building codes, higher appliance efficiency standards, and more recently, a trend toward urban living, and more widespread use of distributed generation, are all impacting the rate of energy demand growth. Trends such as these, which are beyond the control of utilities, appear to be reducing historical levels of growth in electricity sales. As noted below, the historic relationship between economic activity and energy consumption is changing, so that today the rate of growth of electricity use is about half the rate of growth of gross domestic product.

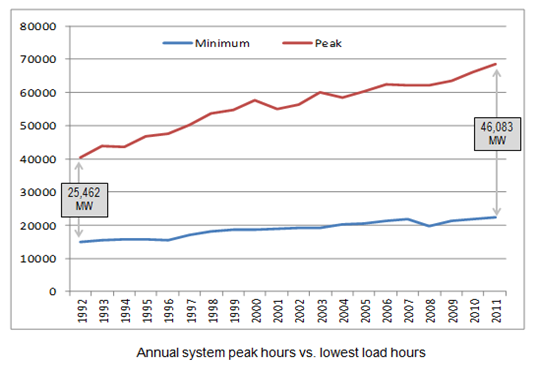

Peak demand, however, continues to rise faster than minimum load, as illustrated below. Peak load is also rising faster than average energy consumption.

Because of these trends, more investment in system assets is required and delivery costs per unit of consumption increase. The capacity factor of the Texas grid is just above 50%, or the equivalent of the system being used fully only half the time, an inefficient use of the grid assets in which we have already invested so much.

As is noted above, there is a disincentive for utilities to reduce the scale of the infrastructure used to serve loads, as long as the utilities’ profit is related to a return on asset investments. Utilities have an incentive to solve problems through capital investment rather than through other alternatives, particularly alternatives that enable improvements to end-use efficiencies. Utility administration of energy efficiency and demand management programs might be targeted in such a manner, for example, to allow a utility to avoid upgrading facilities on its distribution system. Will they voluntarily undertake programs that reduce their investment opportunities? As noted, utilities’ decision-making is constrained by the recognition that regulators can review investments and assess whether a decision was prudent, but the limited resources of regulators make it difficult for them to fully evaluate each grid investment decision, and there is no established process for consideration of efficiency or demand response as an alternative to meeting power delivery needs of the system. Thus, utilities’ profit motive to expand the “iron-in-the-ground” infrastructure is a factor that may impede the development of larger, targeted energy efficiency programs, or broader efforts to enable efficiency innovations in the market place.

To improve the system-wide efficiency of our use of the grid, and to encourage utilities to make it part of their core job to facilitate power retailers and energy service companies to help consumers individually use energy more efficiently, we may need to reconsider our traditional methods of ratemaking.

Alternative Ratemaking Options

Neutralizing the Impact of End-Use Efficiency Gains

Several alternatives have been proposed as means to address the “reduced revenue” disincentive associated with utility operation of energy efficiency and related programs. Measures that would explicitly address the revenue impact of energy efficiency are decoupling, a lost revenue adjustment, and a change in rate design that is referred to as straight fixed/variable rates.

Under decoupling, the utilities’ rates would be adjusted periodically, typically each year, in an expedited regulatory proceeding, so that the utility would recover revenues at the level approved in its last rate case, despite changes in the level of customer consumption (revenue changes related to changes in customer counts may still need to be reflected). This mechanism would continue over multiple years. If the utility under-recovers the authorized revenue in one year, due to reduced energy consumption and demand, it would recoup the deficiency in the following year. If it over-recovers the authorized revenue, it would refund the excess in the following year. The utility would be indifferent to changes in consumption.

A lost revenue adjustment mechanism would each year calculate the revenue loss resulting from a utility’s energy efficiency program or other efficiency initiatives recognized by the State and surcharge that amount to customers in the following year. The utility would be indifferent to changes in consumption from covered initiatives, but would remain motivated to increase demand.

The straight fixed/variable rate approach would redesign customers’ rates. Under existing rates for transmission and distribution utilities (TDUs), most of the utilities’ costs are fixed in nature, yet most of the utilities’ costs for residential customers are recovered through a volumetric charge, a per kilowatt-hour (kWh) charge. Implementing a straight fixed/variable rate would change the TDU rate design so that utility fixed costs would be recovered through a fixed monthly charge, instead of a volumetric charge. The utility would be largely indifferent to changes in consumption if this rate design were fully implemented.

These approaches largely ensure that the utility is neutral to being assigned the responsibility by the state to facilitate energy efficiency of its end use customers. Any of these systems might allow the utilities to administer programs effectively without feeling torn between their obligation under the law and their fiduciary obligation to their shareholders. However, each of these systems also require the State to mandate the implementation of efficiency programs, or the achievement of end-use savings goals, but do not drive a utility to search out ways to help its customers save energy, or ways to increase the effective use of its existing assets.

If the State of Texas determines that there is a need to increase the goal for energy efficiency for the utility programs, one possible solution for the reduced revenue impact issue, at least in the short term, would be to adopt an approach that takes advantage of the existing regulatory mechanism. For example, the existing energy efficiency bonus could be modified to appropriately replace lost revenue as well. The current formula for the bonus is based on the expected energy cost savings resulting from the utility’s energy efficiency program less the utility’s program costs, in other words, the net benefits of the program. A modified formula could be based on the net benefits and level of lost revenue.

To address how efficiently we use the assets of the electric grid—in which we have already invested billions of dollars—TDUs might be directed to recover their rates through demand or capacity charges (or perhaps something like the fixed/variable rates discussed). Such a change is not an effort to change the utility’s incentives, but if the competitive retailers passed on to customers the TDUs’ rates and rate design, then incentives for customers would change. TDUs already recover their transmission and distribution costs at least in part through capacity charges for many commercial and industrial customers. Requiring utilities to recover all or more of their revenues from retail electric providers based on the capacity required to serve their load would assure that a stronger price signal went out to REPs, and potentially thereby to end-use customers, of the cost of capacity, and provide an incentive to reduce demand or peak demand. Appropriate load shifting responses would improve the overall capacity factor of the grid and avoid the need for additional capital investments. REPs would be further encouraged to expand their rate and service offerings to affect usage patterns or stimulate use of innovative new technologies.

Performance-based rate-making is a broad concept for compensating regulated companies according to how well they perform on identified activities or outputs. It could include a complete overhaul of current utility regulation, or something as simple as allowing utilities to earn a higher rate of return for reaching certain goals, such as increasing the utilization of the transmission and distribution system, or facilitating the reduction of per-customer usage through REPs and Energy Service Companies (ESCOs). A number of states have adopted performance payments for energy efficiency and/or other goals that would better align the interests of utilities with those of customers. Other goals for which utilities are compensated under other systems include:

- System reliability.

- Customer service.

- Increased load factor. We use only 50% of the system capacity at most times, since the grid is built to meet peak demand. Utilities could earn higher returns if they shift peak.

- Strategic load reductions.

- Avoid the need for additional infrastructure, in order to lower costs.

- Total cost of service.

- Texas could develop a cost oriented metric to incentivize utilities to help lower the average cost of electric bills.

- Texas has the third highest electric bills in the nation. The PUC’s Strategic Plan notes while the average price of electricity per kWh in Texas for residential customers is 99.17% of the national average, the average annual residential electric bill is 123.25%. The PUCT goal is to reduce that down to 111% by 2019, but there is no mechanism to reach that goal. A performance based metric could help.

- Productivity and efficiency of utility’s operations.

Conclusion: Putting it All Together

By adopting various combinations of these alternatives, it would be possible to align utility interests to public interests, both assuring the utility is made whole for supporting and even facilitating efficiency improvements, in the market, and in the use of its regulated assets, and internalizing incentives for excelling at each.

For example, by adopting a streamlined lost revenue recovery process and a more robust efficiency incentive bonus calculation, utilities might be motivated to be more active champions of efficiency, both for end use customers and for the electric system. This could lead to lower overall costs, at the same time utilities could receive increased profits for achieving goals that strengthen the economy. Overall, the State should consider forms of regulation that allow utilities to be indifferent to sales, weather, and other perturbations and instead become more focused on service, quality, and lower electric bills for their customers.

Changing the form of rate regulation for the State of Texas would be a relatively complex task, as the efforts of other states have made clear. Adapting to the broader market changes under way, and supporting efficiency and innovation in the market place, while protecting the integrity of our public utilities is a non-trivial undertaking. Still, doing nothing will also threaten the financial well-being of our utilities and/or hinder the rate of adoption of efficient technologies, given the larger shifts taking place. So this is a larger conversation which the state leadership, and the stakeholders, should begin to take up if we are to remake the relationship of the utilities to the market over the next decade.