Texas prides itself in being an energy leader for the country, making it an ideal place for residents and businesses alike to thrive. Texas leads the nation in oil, gas, and wind generation, producing 42%, 27%, and 26%, respectively. In addition, the state is making strides in solar, hydrogen, and battery storage [1]. However, with all this generation we still see the average electricity price increasing year after year, from 11.73 cents per kWh in 2020 to over 14.28 cents per kWh in 2023. This begs the question, what is being done to reduce costs? The answer to that question is complex, but one piece of the equation that deserves more attention is energy efficiency.

While Texas maintains its leadership position in generation, it used to be the leader in energy efficiency as well. Starting back in 1999 with the passage of SB 7, the nation’s first Energy Efficiency Resource Standard (EERS) was established requiring Texas utility companies to reduce total demand of electricity annually. Energy efficiency reduces total consumption on the electric grid through various measures, like improved insulation and windows, more efficient everyday appliances, and weatherization of buildings and homes, requiring less energy to do the same activities. However, since the implementation of SB 7, Texas has seen its leadership position fall dramatically to last place of the 29 states that currently have EERS policies, according to ACEEE. That’s not to say the programs aren’t working, but rather that there is room for growth.

IOU Program Highlights

Each investor-owned utility (IOU) maintains a portfolio of several different energy efficiency programs. These break down into standard offer programs (SOP) and market transformation programs (MTP). SOPs allow utilities to offer incentives to use a specific type of energy efficiency measure. These programs utilize a standard terms and conditions contract, and include commercial, residential and small commercial, low income, and load management programs. MTPs are long-lasting strategic efforts to change the market. They are designed to reduce barriers for energy efficiency measures to be adopted, and include offers like residential, commercial, hard to reach, and multi-family programs. Also included in the cost of the EE portfolios is administrative costs (including research and development, and EM&V) and a performance bonus.

Annually on April 1st the Energy Efficiency Plan & Reports (EEPR) are filed with the Public Utility Commission of Texas (PUCT). In docket 56003 you will find each IOU EEPR filed in 2024 that provides a plethora of information on current and new programs, as well as historical data on energy efficiency efforts, spending, and future estimates. We would like to share some initial highlights from this year’s EEPR filings.

First Impressions

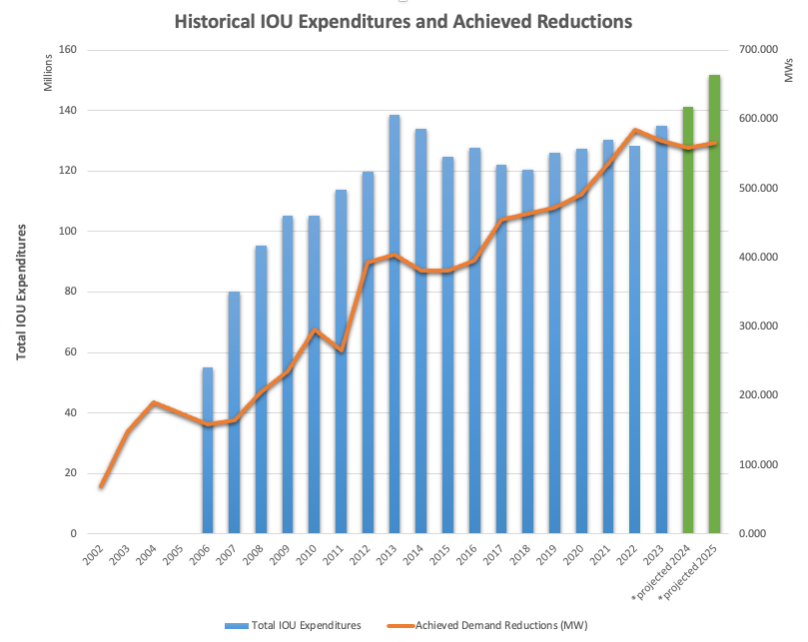

In program year 2023, through these programs the IOUs reduced demand a total of 568 megawatts (MW) on the system. They also achieved energy savings of 16,584,061 megawatt hours (MWh). The program budgets are expected to grow over the next two years to $141M in 2024 and $151M in 2025, barring any changes to the current rules at the PUCT. While many programs are anticipated to maintain existing measures into the 2024 and 2025 cycles, there are also a few new pilot programs and studies being developed to implement recent legislation like SB 1699 and address new needs for the state.

Smart Thermostat Programs:

Multiple utilities are developing smart thermostat pilot programs in their territories. New for 2024, AEP Texas is deploying its Multi-family Smart Thermostat Program pilot, which targets residential multi-family properties and provides incentives for the installation of qualified Energy Star thermostats for AEP customers. Oncor is developing a Smart Thermostat Pilot Market Transformation Program to be implemented in 2025, which would deploy smart thermostats and increase automated demand response capabilities for residential customers while addressing goals from SB 1699. In 2025, Entergy Texas is seeking to expand its DEM SOL program, including adding more smart thermostats and expanding into other curtailable technologies.

Other Pilot Programs:

AEP Food Service Pilot Program – Late last year AEP Texas launched the Food Service Program (pilot) which targets the commercial food service industry, featuring a point-of-sale incentive for equipment dealers. The program is designed to encourage end-users to upgrade to Energy Star and/or more efficient equipment for their business.

EV Charging Study:

Oncor and CenterPoint are both seeking to conduct their own research on the impact of electric vehicles to the electric grid in their respective territories. Oncor’s study hopes to provide educational opportunities for commercial properties. They want to learn the benefits of peak demand shifting and energy consumption reduction strategies for EV fleets and EV charging locations. CenterPoint’s study will also analyze EV-managed charging for fleet vehicles and assess the savings potential for EV charging load management, understand customer behavioral responses, and evaluate capabilities for commercial customers.

Market Potential Study:

CenterPoint will be conducting a Market Potential Study for its service area to determine electric energy and demand savings and the associated costs that can be achieved by demand-side management programs. It will analyze opportunities for residential and commercial customers, allowing the company to review growth targets and design program offerings to maximize value. It should be noted that while the proposed study is for just the CenterPoint territory, the last statewide energy efficiency potential study was completed in 2008.

Deeper Dive into Program Achievements

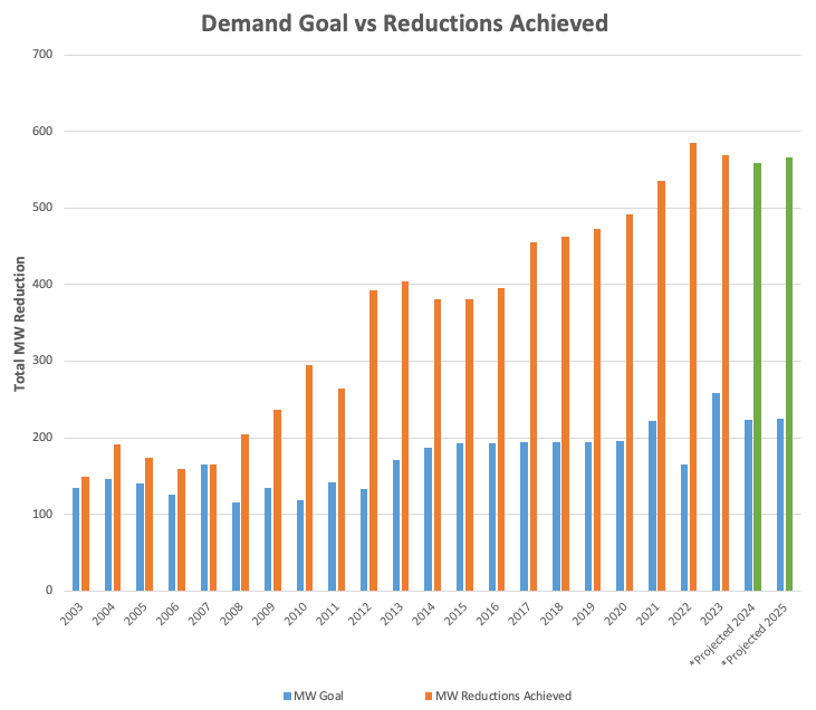

The above graph shows that historically the IOUs consistently exceed their required MW reduction goals by leaps and bounds. Since 2012 their achievements roughly doubled, or more their respective goals annually with the inclusion of demand response (DR) programs. In 2023 alone, the total MW reduction goal for the eight IOUs in Texas was 259 MWs, and they exceeded 568 MW in achieved reductions [2]. Furthermore, according to ERCOT, one MW is equivalent to roughly 200 homes powered during peak demand [3]. This would mean the IOUs could provide additional power to over 114,000 Texas homes when the grid was most stressed in 2023, due to these programs’ existence. Since the inclusion of DR into the programs, the total demand reductions achieved have increased by over 70% [4]. Additionally, the IOUs are achieving increasing amounts of demand reductions while their budgets remain relatively stagnant, fluctuating between approximately $120-140M annually for total IOU programs expenditures in that period. This shows that energy efficiency is incredibly cost-effective with recent benefit cost analysis showing a ratio of 3:1. With the added context that peak demand records have been broken dozens of times in the last few years and will continue to do so in the future, saving MWs across the system is of utmost importance now. These reports lend credence to the saying “the cheapest MW is the one not used.”

Can More be Done?

Load forecasts are showing peak demand exceeding 90+GWs in the coming years (current peak demand record is 85.5GW, set last year). State energy leaders are attempting to address the influx of demand with more generation-side resources. The new low interest loan program Texas Energy Fund and the Performance Credit Mechanism market design are both in early stages of development and the outcomes of those attempts will not be ready for extreme weather now. However, energy optimization, efficiency, and the whole suite of demand-side management programs are ready now, they just need the direction from policymakers to grow. Estimates by ACEEE show the potential for EE in Texas to be substantial with possible savings of at least 15GWs in summer peak and over 25GWs in winter peak with strategic implementation and increased funding.

SPEER believes there is a tremendous opportunity to increase the achieved demand reductions through incremental regulatory changes to the current programs. We published a report in 2022 outlining many recommendations: IOU Program Review 2022 Report. While it is our belief that policy changes should be considered at the PUCT, the IOUs continue to develop their programs and add new ones every year. This results in new and continued savings that benefit customers by lowering energy bills monthly, as well as increasing resiliency and reliability to the Texas grid at large.

In 2023, the PUCT hosted a series of stakeholder workshops with the aim of exploring potential changes to the energy efficiency rules aimed at enhancing performance. With wide industry and stakeholder input, in addition to the implementation of new statutes on-going at the PUCT, we are hopeful that an energy efficiency rulemaking will be opened to address the needs of the state through improved energy efficiency rules. Additionally, in the 88th Texas Legislature, SB 258 was the first EE bill to move out of one chamber of the Legislature in over a decade, although it did not pass the second chamber, the Texas House of Representatives. If Texas moves forward with regulatory and/or legislative changes to cost-effectiveness criteria, program cycles, low-income requirements, and avoided cost calculations among other possible changes, Texas will have a bridge to reduce load in the immediate future while also planning for long-term generation needs. It will also establish a new baseline for what is achievable by the IOUs demand-side programs to guide future decisions regarding the EE efforts.

[1] https://comptroller.texas.gov/economy/economic-data/energy/2023/texas.php

[2] 2024 EEPR Filings

[3]https://www.ercot.com/gridmktinfo/dashboards/fuelmix#:~:text=Monthly%20Capacity&text=1%20MW%20of%20electricity%20can,during%20periods%20of%20peak%20demand.

[4] 2006-2024 EEPR Filings