Highlights

-

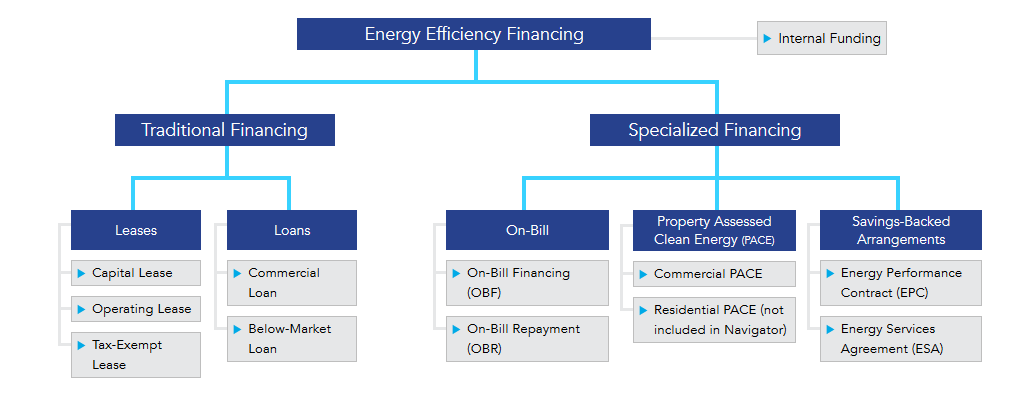

- The Department of Energy’s Better Buildings Financing Navigator provides an overview of an array of financing options, ranging from traditional self and debt financing to innovating options including Property Assessed Clean Energy (PACE) and Energy Service Performance Contracting (ESPC)

- In Texas, the LoanSTAR Revolving Loan Program offers cities and other public sector entities low-interest financing for energy and water efficiency upgrades and performance contracting in their facilities.

- Internal financing, including revolving loan funds, can provide cities a high level of control and flexibility in their energy efficiency project development.

Financing Energy Efficiency

Better Buildings Energy Efficiency Financing Navigator

The US Department of Energy (DOE)’s Better Buildings Financing Navigator is a free online resource that uses basic project information to identify financing options that best align with a city efficiency project needs. The Navigator can save significant time and reduce the research barrier for cities taking the initial step of exploring the world of available financing options.

Source: US Department of Energy.

Local governments also have the option to “Connect with Financial Allies” straight from the Navigator, identifying experienced and knowledgeable partners about financing energy efficiency upgrades and PACE projects.

Explore the financing navigator, find financing that fits your city’s needs, and connect with partners here.

LoanSTAR Revolving Loan Program

In Texas, the LoanSTAR Revolving Loan Program offers cities and other public sector entities low-interest financing for energy and water efficiency upgrades and performance contracting their facilities.

The LoanSTAR program is administered by the State Energy Conservation Office (SECO). Since its inception, the program has funded over 290 loans and achieved cumulative energy cost savings of $571 million for participating facilities. The measures installed through LoanSTAR funding have prevented the release of over 15,801 tons of nitrogen oxide, 5.5 million tons of carbon dioxide, and 11,795 tons of sulfur dioxide into the atmosphere.

Resources

Tax-Exempt Lease Purchase Agreements

Resources:

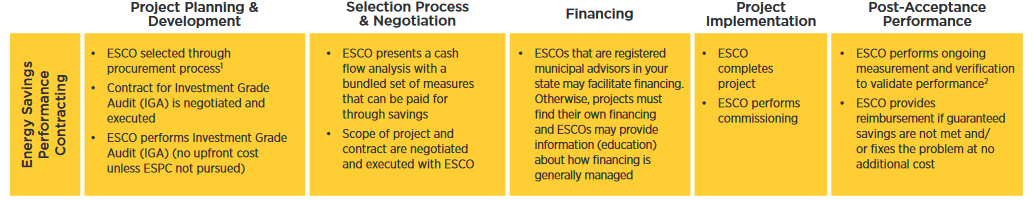

Energy Service Performance Contracting (ESPC)

Under the ESPC model, cities partner with an energy services company (ESCO). The ESCO performs an investment-grade energy audit of city facilities, identifies energy and water saving measures, and creates a proposal from those audit findings. If the project moves forward to the implementation stage, the ESCO guarantees the performance savings from installed measures. Measurement and verification of the measures is performed on an ongoing basis to ensure the savings are being met.

Source: US Department of Energy – Office of Energy Efficiency and Renewable Energy.[/expand

Energy Savings Performance Contracting Guidelines for State Agencies

The State Energy Conservation Office, in collaboration with energy service companies and end-users, developed Energy Savings Performance Contracting Guidelines for State Agencies. These guidelines offer step-by-step guidance specific to projects developed under Texas Government Code Section 2166.406, the enabling legislation of ESPCs for State Agencies.Although developed for State Agencies, the guidelines provide a structure that can also be used by other public entities including K-12 schools and local governments. They include helpful tools, like a Request for Qualifications (RFQ) Template for an ESPC as well as an outline contract, to support public institutions in their performance contracting process. SECO can also provide Measurement and Verification Provider Certification Forms, Third Party Review Certification Forms, and review checklists for Chief Financial Officers and General Counsel.

Energy Savings Performance Contracting (ESPC) Toolkit

Highlights of the Better Buildings ESPC Toolkit include:

-

- Customizable Sample Documents and Contracts for every stage of an ESPC project, including RFQs, RFPs, Base Contracts, a full Energy Savings Performance Contract, and Financing Solicitations.

- Best Practices for Selecting an ESCO, which include a spreadsheet template to evaluate proposals, a recommended step-by-step process to evaluate proposals, and specific questions to ask ESCOs during the interview process

- Financing Decision Tree that helps local governments identify financing options for ESPC projects

Explore the entire Better Buildings ESPC Toolkit here to learn more

Other ESPC Resources

Case Study: Energy Service Performance Contracting in Fort Worth

Read the City of Fort Worth’s ESPC case study here.

Internal Funding and Revolving Funds

The Better Buildings Financing Navigator provides guidance on internal funding to assist local governments who are considering this option. The Navigator outlines advantages and drawbacks of several internal methods that cities can use finance energy conservation projects including:

-

- Operating or Capital Budget Expenditure

- Self-Funded Energy Service Performance Contract

- Capital Investment Fund

- Revolving Loan Fund

- Internal Carbon Pricing

Learn more about each internal funding option at the navigator here.

Case Study: City of San Antonio's Revolving Loan

The city uses this fund to manage energy efficiency building measures as well as efficiency improvements in larger capital projects. As the efficiency projects realize savings, the city returns a portion of the savings to the fund to be used in future projects.

Benefits of the city’s revolving fund include a reduced debt burden for energy efficiency projects, positive cash flow, the flexibility to implement projects quickly, internal management of projects, and significant energy reductions.

Read the full San Antonio “Revolving Loans for City Efficiency Projects” case study.

Report: Current Practices in Efficiency Financing

The report contains information on traditional financing products (unsecured loans, secured loans, and leases) and specialized financing products (on-bill financing, PACE, ESPC, and more) along with information on the advantages, disadvantages, and tradeoffs of each approach.

PACE Financing